Sign in

Welcome back

System availability

notice

Our Guaranteed Issue Program streamlines the process for obtaining life insurance. With just a little paperwork, groups go through underwriting based on formulas and employee classifications, instead of lengthy medical questionnaires and exams. Guaranteed Issue can be an excellent way for employers to attract, reward and retain key employees who are in good health, with the flexibility to add more employees in the future. It is not a way to provide insurance for substandard or uninsurable employees.

Employers can choose to apply to add long-term care to their Guaranteed Issue life insurance when they have 20 or more highly compensated key executives. Our Long-Term Care ServicesSM Rider (LTCSR) is the only true long-term care rider in a Guaranteed Issue program and provides a way for employers to offer the long-term care coverage their key executives want and need. There are additional requirements and employees will need to complete a simplified LTCSR questionnaire for coverage.

To qualify for Guaranteed Issue life insurance, groups will need to meet certain requirements, including:

To qualify for Guaranteed Issue with the LTCSR, groups will need to meet all the life insurance requirements, as well as:

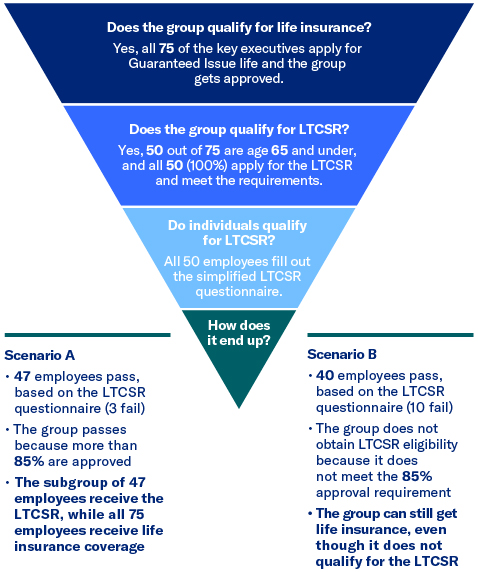

Company ABC wants Equitable’s Guaranteed Issue life insurance and the Long-Term Care ServicesSM Rider.

The Long-Term Care ServicesSM Rider is available for an additional fee and does contain restrictions and limitations. A client may qualify for the insurance but not the rider, be sure to review the product specifications for details. The rider is paid out as an acceleration of the death benefit.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America, an Arizona stock corporation with its main administration office in Charlotte, NC and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC. When sold by New York based (i.e. domiciled) financial professionals life insurance products are issued by Equitable Financial Life Insurance Company, (NY, NY). All companies are affiliated and directly or indirectly owned by Equitable Holdings, Inc., and do not provide tax or legal advice.

References to Equitable in this page represent both Equitable Financial Life Insurance Company and Equitable Financial Life Insurance Company of America, which are affiliated companies.

Policy loans and withdrawals will reduce the face amount of coverage and the cash value of a contact. Clients may need to fund higher premiums in later years to keep the policy form lapsing.

IU-6887494.1 (08/2024) (Exp. 08/2028)