Sign in

Welcome back

System availability

notice

Approximately 70% of investors expressed concerns about market volatility affecting their financial well being.1 With our tools, resources and insights, you can help clients feel confident about their investment portfolio and maintain a long-term perspective.

The sequence of investment returns can be one of volatility’s biggest threats in a down market. Our Retirement Cornerstone® variable annuity offers clients a level of protection against market volatility and more ways to grow retirement income, including interest-based increases, market-based increases and by withdrawing less than their maximum annual amounts so the remainder can continue to compound.

Our innovative MSO II Indexed Options provide your clients with more flexibility, choice and equity upside potential in up, down and flat markets. The Market Stabilizer Option® II is available with all our individual variable universal life insurance products.

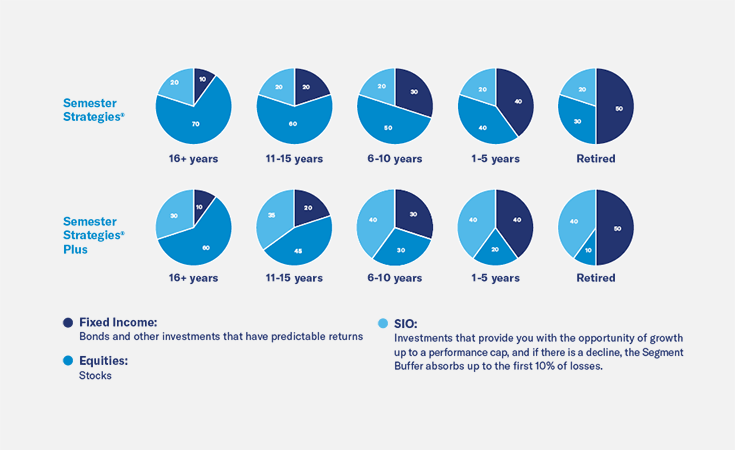

Plan participants still need a way to effectively manage market volatility as they save during their working years. Semester Strategies®, available through EQUI-VEST® group variable annuity, offers model portfolios that help diversify retirement assets while offering partial downside protection when markets decline.

For financial professionals only. If you are an individual investor, please contact your financial professional for more information.

1 2023 National Financial Capability Study, FINRA.

2 Source: https://equitable.com/about-us/financial-strength-ratings

Past market behavior and investment performance does not guarantee similar or comparable future outcomes or performance. Investing involves risk, including loss of principal.

Annuities are long-term financial products designed for retirement purposes. Variable investment options within variable annuities are subject to fluctuation in value and market risk, including the possibility of loss of principal. In addition, annuity policies have limitations and a charge for withdrawals in the policy’s early years. For costs and complete details, contact the Equitable Individual Retirement or the Group Retirement Sales Desks.

Life Insurance and annuities are issued by Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY) and Equitable Financial Life Insurance Company of America (Equitable America), an AZ stock company. All group insurance products, excluding those issued by a third-party contracted vendor, are issued by either Equitable Financial or Equitable America, which have sole responsibility for their insurance and claims-paying obligations. Some products are not available in all states. The obligations of Equitable America and Equitable Financial are backed solely by their own claims-paying abilities.

References to Equitable represent both Equitable Financial Life Insurance Company and Equitable Financial Life Insurance Company of America, which are affiliated companies. Overall, Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY); Equitable Financial Life Insurance Company of America (Equitable America), an AZ stock company, with an administrative office located in Charlotte, NC, and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI & TN). The obligations of Equitable Financial Life Insurance Company and Equitable Financial Life Insurance Company of America are backed solely by their own claims-paying abilities.

This website does not offer or constitute investment advice and makes no direct or indirect recommendation regarding the appropriateness of any particular product or investment related option.

© 2025 Equitable Holdings, Inc. All rights reserved.

GE-6966641.1 (09/2024) (Exp. 09/2026)