Asset Location

A powerful investment strategy

Discover the power to build wealth more effectively

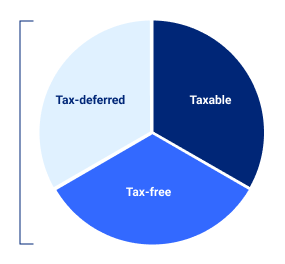

Asset location is quickly emerging as a powerful financial planning framework that focuses on where you hold your investments—not just what you invest in, addressing long-term tax management in a portfolio of investment assets. While asset allocation is all about balancing risk and reward, asset location is about balancing tax efficiency across different types of accounts. By investing across multiple tax platforms – tax-deferred, taxable and tax-free accounts – you can create flexibility and adapt to changing tax laws and financial conditions. Asset location isn’t just a strategy – it’s a vital and foundational approach to managing taxes efficiently and smart financial planning.

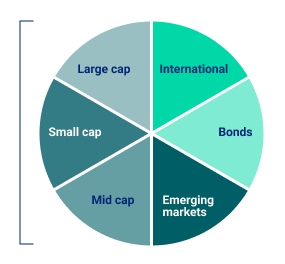

Asset allocation vs. asset location

Balance portfolio risks and tax liabilities with asset location and allocation for a harmonious wealth-building strategy.*

*Asset allocation and asset location are different methods of diversification that do not guarantee a profit nor protect against a loss.

Seeking stability:

Maximize your tax-free retirement income with an efficient, diversified strategy.

Not all accounts are created equal

Refining your tax planning and retirement strategy is easier than you think. By mastering how your assets are distributed across the three tax buckets — tax-deferred, taxable and tax-free — you can seek to enhance your financial outcomes.

1 For more information, please see the important information section.

Asset location in action

Meet Aaron and Ivana Smith

In 15–20 years, Aaron and Ivana want to be able to fund $300,000 from their retirement income each year to maintain their lifestyle in retirement.

Total annual tax savings of $24,385 (82.9%)

* The tax calculations show $50,000 in gross Social Security benefits, with 85% ($42,500) taxable. IRA/401(k) distributions amount to $150,000, and long-term capital gains (LTCG) are $50,000. After a $46,700 standard deduction, taxable income is $195,800. Within this, $145,800 is ordinary taxable income: $23,850 taxed at 10% ($2,385), $73,100 at 12% ($8,772), and $48,850 at 22% ($10,747), totaling $21,904 in ordinary tax. No LTCG remains within the 0% bracket threshold, so the entire $50,000 is taxed at 15%, resulting in $7,500 LTCG tax. Total tax liability is $29,404, with a 9.80% effective tax rate.

** The tax calculations include $50,000 of gross Social Security benefits, of which 85% ($42,500) is taxable. IRA/401(k) distributions total $50,000, and long-term capital gains (LTCG) are $50,000. After applying the $46,700 standard deduction, taxable income is $95,800. Ordinary taxable income of $45,800 is taxed at 10% ($23,850 = $2,385) and 12% ($21,950 = $2,634), resulting in $5,019 of ordinary income tax. All $50,000 of LTCG qualifies for the 0% LTCG tax rate, making it tax-free. Total tax liability is $5,019, with an effective tax rate of 1.67%.

By determining their tax rates, finding the ideal tax locations, applying and tax bracket planning, this couple is able to reduce their effective tax rate from 9.8% to 1.7%.

That’s a savings of 82.9%, or an annual total of $24,385.

This financial gain enables them to allocate funds towards family, travel, hobbies, and personal interests.

Three phases of asset location planning

Secure your Future today with Asset Location

Asset location is all about long-term tax control and flexibility. Thoughtfully building savings across all three tax buckets—and selecting the right investments for each—helps you manage your tax bill in retirement, no matter how laws change. Strategic asset placement can not only help you reduce your tax burden but also help maximize your portfolio's annualized return potential over time.

Take charge now—review your accounts and work with a financial professional to optimize your investments and keep more of what you earn.

Frequently Asked Questions

Anyone looking to minimize tax liability and maximize retirement income can benefit, especially those with diverse investment portfolios.

- Asset allocation is about what types of investments you own (e.g., stocks, bonds, real estate) to balance risk and return based on your goals and risk tolerance.

- Asset location is about where you place those investments (i.e., in a taxable, tax-deferred, or tax-free account) to minimize your overall tax burden.

Strategic asset location can significantly lower your overall tax bill, allowing your investments to grow more efficiently and potentially adding a significant amount to your after-tax wealth over time.

Start asset location planning early for tax efficiency during retirement withdrawals. However, it's beneficial at any stage of your financial journey.

Tax-efficient investments, such as individual stocks held for the long term (which benefit from lower long-term capital gains tax rates) and low-turnover index funds or municipal bonds (which have favorable tax treatment), generally work best in taxable accounts.

Tax-heavy investments that generate high, ordinary-income-taxed income (like bonds, bond funds, and real estate investment trusts (REITs)) are typically better in tax-deferred or tax-free accounts to avoid immediate and higher taxation. Higher turnover investments like actively managed small-cap, and international stock funds are typically better in these accounts as well.

Generally, you should prioritize funding tax-advantaged accounts (like a 401(k), HSA, or IRA) before investing in a standard taxable brokerage account, to make the most of the tax benefits available.

Yes, asset location complements asset allocation and can be integrated as a tax planning strategy into your existing financial plan to enhance tax efficiency.

Asset location strategies offer the most value if you have multiple types of accounts (taxable, tax-deferred, and tax-free) and a significant amount of money across them. However, understanding the principles helps any investor make better use of the accounts they do have.

While individual results vary, expert analysis suggests thoughtful asset location can add 0.75% to 2.00% per year in after-tax returns, which can compound into a substantial difference in wealth over decades.

Assets in taxable accounts generally receive a "step-up in cost basis" upon the owner's death, which can eliminate significant capital gains tax for the heirs. Assets in Traditional IRAs or 401(k)s, however, become Inherited IRAs for beneficiaries and are subject to income tax upon withdrawal, which currently requires the inheritor to disburse the entire account within 10 years.

Your asset location strategy should be reviewed periodically as your financial situation, tax laws, investment mix, and goals change over time (e.g., when approaching retirement). We would recommend at least annually.

Yes, international assets can introduce complexities like foreign withholding taxes, potential double taxation, and specific reporting requirements (though tax treaties may offer some relief). Of course, you can always incorporate asset location with international investments.

Resources

View our educational resources and transform your understanding of asset location planning. These insights will empower you to make informed, strategic decisions for a prosperous future in retirement.

Let’s start planning your asset location journey

Speak to your financial professional to see where you are in your asset location journey. Don’t have a financial professional? Learn more about working with a financial professional.

Prepare for a conversation

- How can asset location fit into my personal financial plan?

- What type of assets do I currently own?

- Am I taking full advantage of tax-efficient strategies across my different tax accounts?

Already a client?

Sign in or register for account balances, transactions, service request forms and advisor contact information.

Visit the customer service page to access more contact information.

Important Information

1 Loans and withdrawals reduce the policy’s cash value and death benefit, may cause certain policy benefits or riders to become unavailable, and increase the chance the policy may lapse. If the policy lapses, is surrendered or becomes a Modified Endowment Contract (MEC), the loan balance at such time would generally be viewed as distributed and taxable under the general rules for distribution of policy cash values. If the policy is a MEC, all distributions (withdrawals or loans) are taxed as ordinary income to the extent of gain in the policy and may also be subject to an additional 10% premature distribution penalty prior to age 59½, unless certain exceptions are applicable.

Contributions to a Roth IRA may generally be withdrawn tax-free at any time. Earnings may generally be withdrawn income tax-free if the individual has held amounts in a Roth IRA for at least 5 years and the withdrawal is made after age 59½. If the withdrawal is made before the 5-year period and age 59 ½, income taxes and an additional 10% federal income tax penalty may apply. Other exceptions may apply.

Please be advised this document is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed. You should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable Financial Life Insurance Company nor its affiliates provide legal or tax advice.

Cash value life insurance is a contractual agreement in which premiums are paid to an insurance company, and the company in return for those premiums provides a benefit to a named beneficiary upon proof of the insured’s death and a policy cash value. Cash value life insurance policies have exclusions, limitations, and terms for keeping the policies inforce. Fees and charges associated with cash value life insurance include, but are not limited to, cost of insurance charges, surrender charges, administrative fees, and charges for optional benefits. Please see the policy’s specifications for more complete information.

Under current federal tax rules, loans taken from a cash value life insurance contract will generally be free of current income tax as long as the policy remains in effect until the insured’s death, does not lapse or mature, and is not a modified endowment contract. This assumes the loan will eventually be satisfied from income tax-free death proceeds. Loans and withdrawals reduce the policy’s cash value and death benefit and increase the chance that the policy may lapse. If the policy lapses, matures, is surrendered or becomes a modified endowment, the loan balance at such time would generally be viewed as distributed and taxable under the general rules for distributions of policy cash values.

The sample case study is hypothetical and is provided here for general discussion only.

Life insurance products are issued by Equitable Financial Life Insurance Company (NY, NY) or Equitable Financial Life Insurance Company of America, an AZ stock company with an administrative office located in Charlotte, NC, and are co-distributed by Equitable Network, LLC (Equitable Network) Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR) and Equitable Distributors, LLC. When sold by New York state-based (i.e., domiciled) Equitable Advisors Financial Professionals, life insurance products are issued by Equitable Financial Life Insurance Company (NY, NY).

References to Equitable in this website represent both Equitable Financial Life Insurance Company and Equitable Financial Life Insurance Company of America, which are affiliated companies. Overall, Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company (NY, NY); Equitable Financial Life Insurance Company of America, an AZ stock company with an administrative office located in Charlotte, NC; and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI & TN).

© 2026 Equitable Holdings, Inc. All rights reserved.

GE-8737544.1 (02/2026) (Exp. 02/2030)