1 This calculator is for general illustrative purposes only and is available here for your independent use. Its results and output are not intended, and should not be relied on, as investment, financial, insurance, tax, accounting or legal advice, or as a recommendation of any kind. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues, including the potential for student loan forgiveness. All calculator results are based on information and assumptions provided by you. Actual results will vary. The calculator does not guarantee that a particular outcome will occur.

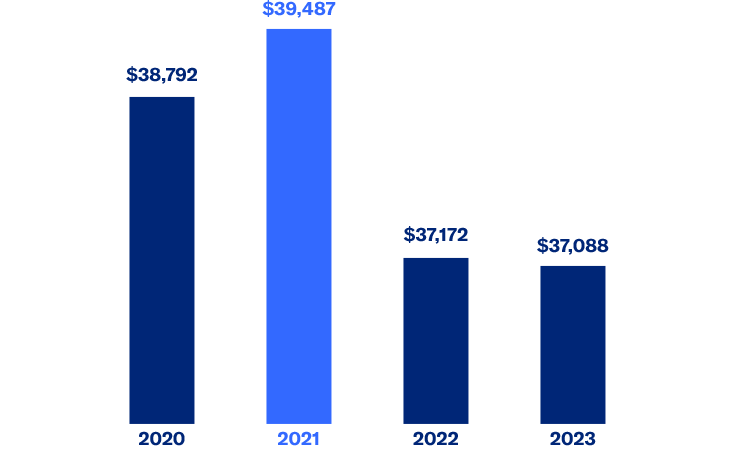

2 https://studentaid.gov/data-center/student/portfolio: Q4 2023

Securities offered through Equitable Advisors, LLC (NY, NY) (212) 314-4600, member FINRA, SIPC (Equitable Financial Advisors in MI & TN). Investment advisory products and services offered through Equitable Advisors, LLC, an SEC-registered investment advisor. Annuity and insurance products offered through Equitable Network, LLC.

Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY), Equitable Advisors, LLC (NY, NY (212) 314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI & TN), and its associates do not provide tax or legal advice and the information provided is general in nature and should not be considered legal or tax advice. Please consult with an attorney, tax professional, or other advisor regarding your specific legal or tax situation.

The calculations from the tool are accessible to you through a third-party vendor arrangement with Student loan Gurus. Student loan Gurus is not affiliated with Equitable Financial, Equitable Advisors or its affiliated companies and neither Equitable Financial, Equitable Advisors nor its financial professionals are responsible for the output data or the determination of your eligibility for the Public Service Loan Forgiveness (PSLF) program. Those services are the sole responsibility of Student loan Gurus. Equitable Advisors, Equitable Financial and its affiliated companies are not responsible for the output provided by Student loan Gurus. Please note that you are not obligated to enroll for the PSLF program or to use Student loan Gurus or any other service to enroll in the PSLF program. You can enroll in the PSLF program on the federal government website free of charge. Further, the PSLF program is available whether or not you participate in a retirement plan.

Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company (NY, NY); Equitable Financial Life Insurance Company of America, an AZ stock company an administrative office located in Charlotte, NC; and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI & TN). The obligations of Equitable Financial and Equitable America are backed solely by their claims-paying abilities.

© 2024 Equitable Holdings, Inc. All rights reserved.